Mention and Explain Different Types of Capital Available to Companies

At the time of registration of a company the Memorandum of Association mentions the amount of capital a company is authorised to raise from the public by selling shares which is known as Authorised Capital or Normal Capital or Registered Capital. The capital so stated is called Registered Authorized or Nominal Capital.

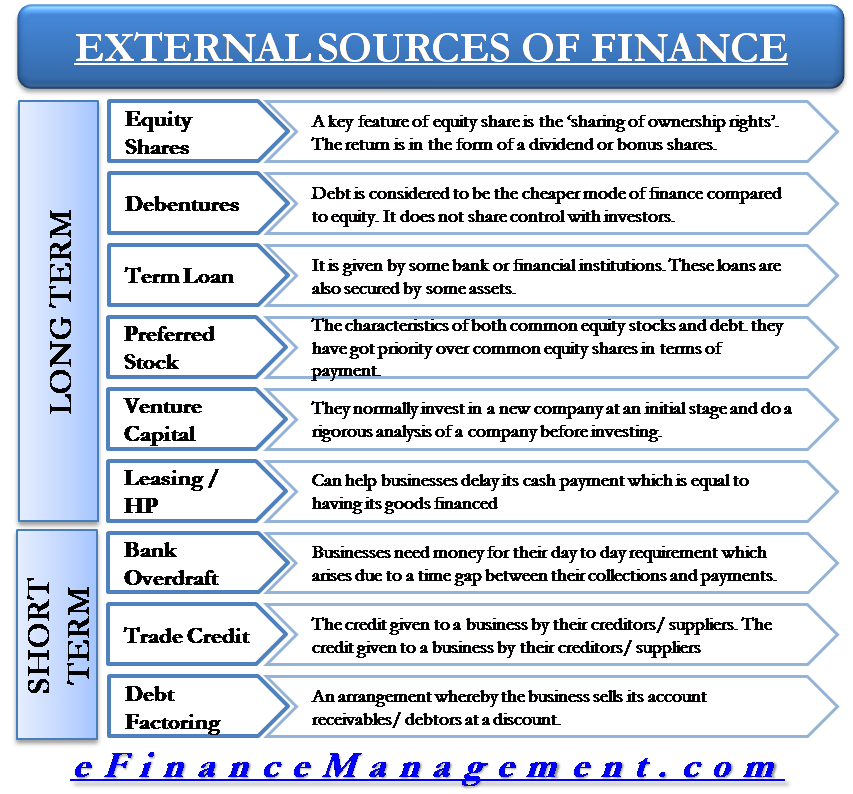

External Sources Of Finance Capital

Other Types of Companies a Government Companies.

. Here is the list of different types of capital market in secondary market available for trading securities. Different Types of Companies. Repayment In case of a winding up or repayment of the amount of paid-up share capital there is a preferential right to the payment of any fixed premium or premium on any fixed scale.

It also promotes the. The subsidiary of a Government company is also a Government company. There are various types of secondary markets where an individual investor or a company can buy or sell securities from one person to other person.

The Memorandum or Articles of the company specifies the same. Defined us 245 of the CA 2013 Government company means any company in which not less than 51 of the paid-up share capital is held by the Central Government or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments and includes a company which is a subsidiary company of such a. Retained earnings are part of the profit that has been kept separately by the organisation and which will help in strengthening the business.

It can be further divided into positive net working capital and negative net working capital. Share Capital of a Company Type 1. Unless a company conducts the necessary research and development to develop new products to improve existing products or services and to discover ways to operate more efficiently that company and the economy in.

Analyzing different types of capital investment projects and investing in the most profitable projects is what gives life and growth to a company. Share capital can be categorized as authorized share capital issued share capital subscribed share capital called up share capital and paid up share capital. On the basis of members.

Working capital is the capitalfunds required for day to day operations of the business. Besides his extensive derivative trading expertise Adam is an expert in economics and. Contributed capital is the amount of money which the company owners have invested at the.

Authorized share capital refers to the total capital that a company is authorized to. It means any company in which not less than 51 percent of the paid up share capital is held by the Central Govt andor by any State Government or Governments or partly by the Central Government and partly by one or more State Governments. Equity Share Capital Equity Shares.

On the other hand negative net working capital is when the liabilities outdo the assets. Financial backing usually includes loans grants or investor funding. The former is when your companys current assets exceed its current liabilities.

It consists of two different types. The payment is usually made electronically wire. The most common types of companies are.

It is usually invested in all types of inventories such as raw materials spares finished goods etc and credit extension to debtors and cash in hand. The Memorandum of Association of every company has to specify the amount of capital with which it wants to be registered. Below is a list and a brief description of the most common types that shareholders receive.

Registered Authorised or Nominal Capital. Adam Hayes PhD CFA is a financial writer with 15 years Wall Street experience as a derivatives trader. Before discussing return on capital further it is important to distinguish between the two types of capital.

Registered or Incorporated Companies. OPC or one person company is a new category of company introduced to encourage startups and young entrepreneurs wherein a single person can incorporate the entity. Government companies are those in which more than 50 of share capital is held by either the central government or by one or more state government or jointly by the central government and one or more state government.

Foreign companies are incorporated outside India. All share capital which is NOT preferential share capital is Equity Share Capital. Companies Limited By Shares.

Cash this is the payment of actual cash from the company directly to the shareholders and is the most common type of payment. It is a legal entity incorporated under the Companies Act 2013 or any other previous acts prevalent in the country. Theres also sweat equity which can be harder to gauge but is still helpful to keep in mind especially when youre looking at a small or startup business.

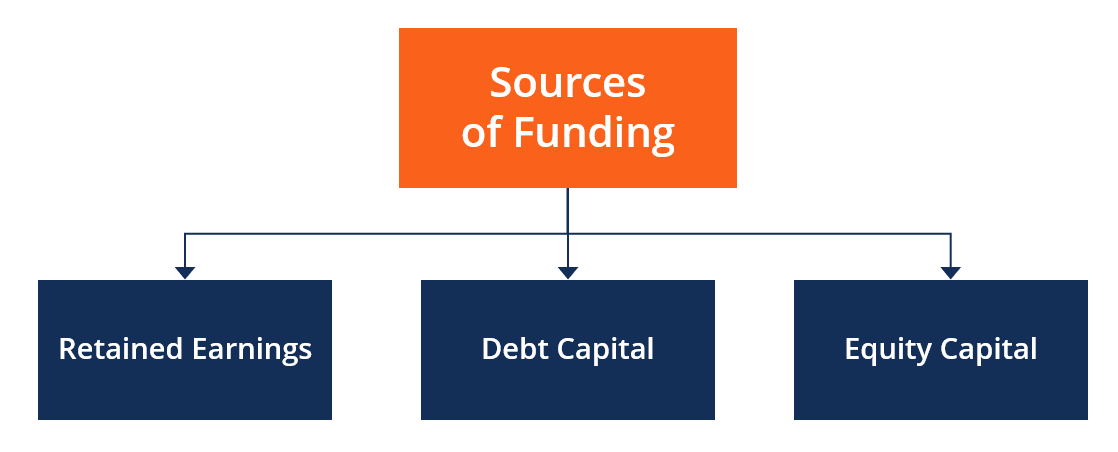

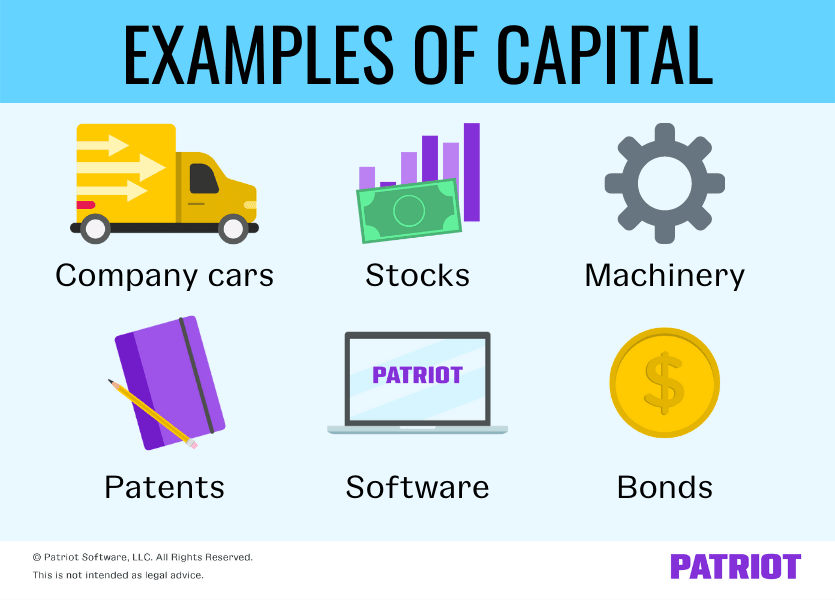

There are three types of financial capital. Some of the top ways to raise capital are through angel investors venture capitalists government grants and small business loans. Equity debt and specialty.

In such a situation seeking a working capital loan will help you restore balance. Companies can be classified into different types based on their mode of incorporation liability of the members and number of the members. The share capital of company may be of the following types.

A business capital structure is the way that it is funded either through debt loans or equity shares sold to investors financing. There are various types of dividends a company can pay to its shareholders. Equity capital is the money owned by the shareholders or owners.

As we mentioned above two types of investors invest capital into companies.

/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)

What Are The Types Of Capital Expenditures Capex

What Are The Documents Required For Setting Up A Private Limited Company In Singapore Find Here The Answer Private Limited Company Create A Company Company

Do You Use Fundamental Analysis To Research A Company If You Do Here Are Six Ratios You Might Have Money Strategy Investment Analysis Money Management Advice

/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)

What Are The Types Of Capital Expenditures Capex

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Venture Capital Features Types Funding Process Examples Etc

Kris Roglieri In Small Business Opportunities Magazine

Venture Capital Features Types Funding Process Examples Etc

/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)

What Are The Types Of Capital Expenditures Capex

Sources Of Funding Overview Types And Examples

What Are Equity Funds Meaning Types Benefits Of It Mutual Funds Investing Equity Investing

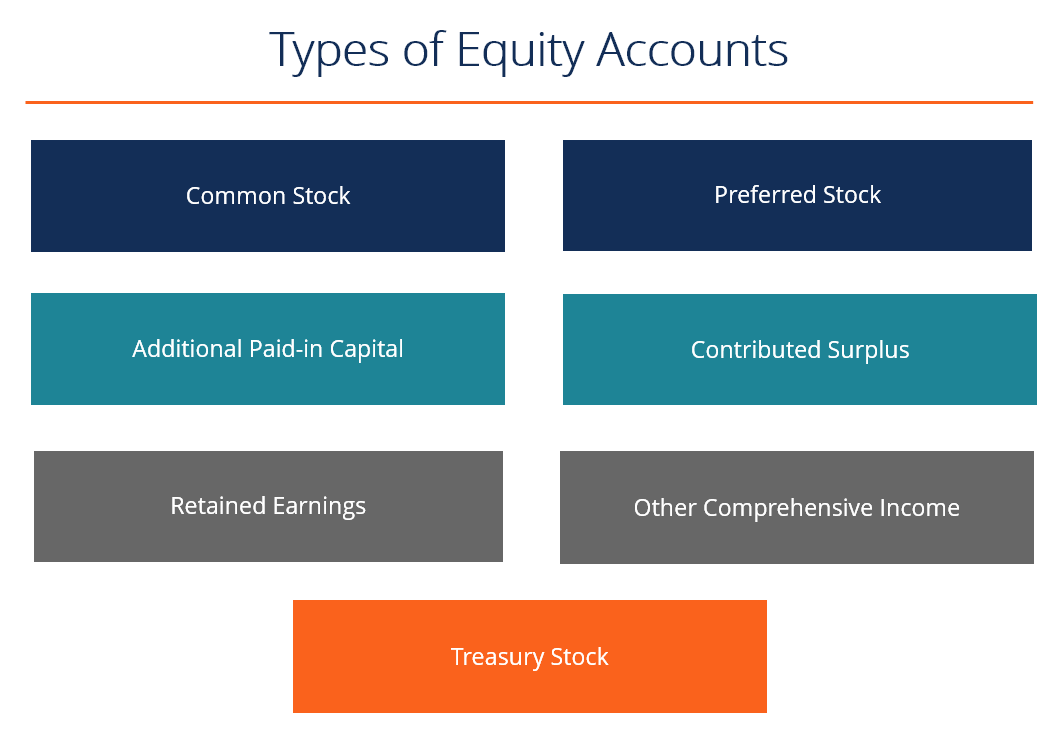

Types Of Equity Accounts List And Examples Of The 7 Main Acocunts

Angel Investors Angel Investors Finance Investing Budgeting Finances

What Are The Sources Of Business Finance Business Finance Finance Business

What Are The Key Differences Between Transfer Transmission Of Shares Transmission How To Find Out Transfer

Comments

Post a Comment